Yet again, the US government hit the debt limit set by Congress on January 19, 2023. Breaking this cap would spell economic disaster for the US and the rest of the world.

The debt limit is the maximum amount of money the federal government can borrow to finance its operations. Currently, the debt limit is set at $31.4 trillion. While the US government has hit the ceiling over 90 times in the last century, they have never broken it. Instead, Congress has adjusted the cap over 100 times since World War II to accommodate excessive spending. The most recent instance of this was in December 2021, when the debt ceiling was increased by $2.5 trillion.

The US government has always operated in a deficit, meaning it spends more on defense and social programs than it earns from tax revenue. As a result, it borrows massive amounts of money by selling marketable securities like government-issued bonds. Thanks to deficit spending, a higher debt limit would not allow the government to spend on new commitments.

If the US goes over the debt ceiling, it cannot borrow more money to pay off its deficit, which could lead to severe economic mayhem that would impact the entire world. In particular, the country is facing a looming threat of defaulting in mid-2023. If the US defaults on debt, its credit rating would drop and social programs like Social Security, Medicare, and veteran benefits could be affected. Soon, interest rates could skyrocket and the stock market could deteriorate. A recession would be especially catastrophic for the economy because it is still recovering from the COVID-19 pandemic.

A default on US debt would also have major consequences on the world economy. The US government is known to always pay back its debt, so banks, financial institutions, businesses, and foreign entities hold trillions of US dollars and US Treasury bonds to secure their assets. If people lose confidence in the US dollar and Treasury bonds, the financial system could crumble worldwide.

The most recent time the US hit its debt limit was back in 2011 when stock prices and retirement savings plunged and the country’s credit rating was downgraded for the first time. While the government avoided defaulting, the economy took a blow, requiring months to recover. The US may face these consequences soon and the government must act to circumvent an even greater catastrophe.

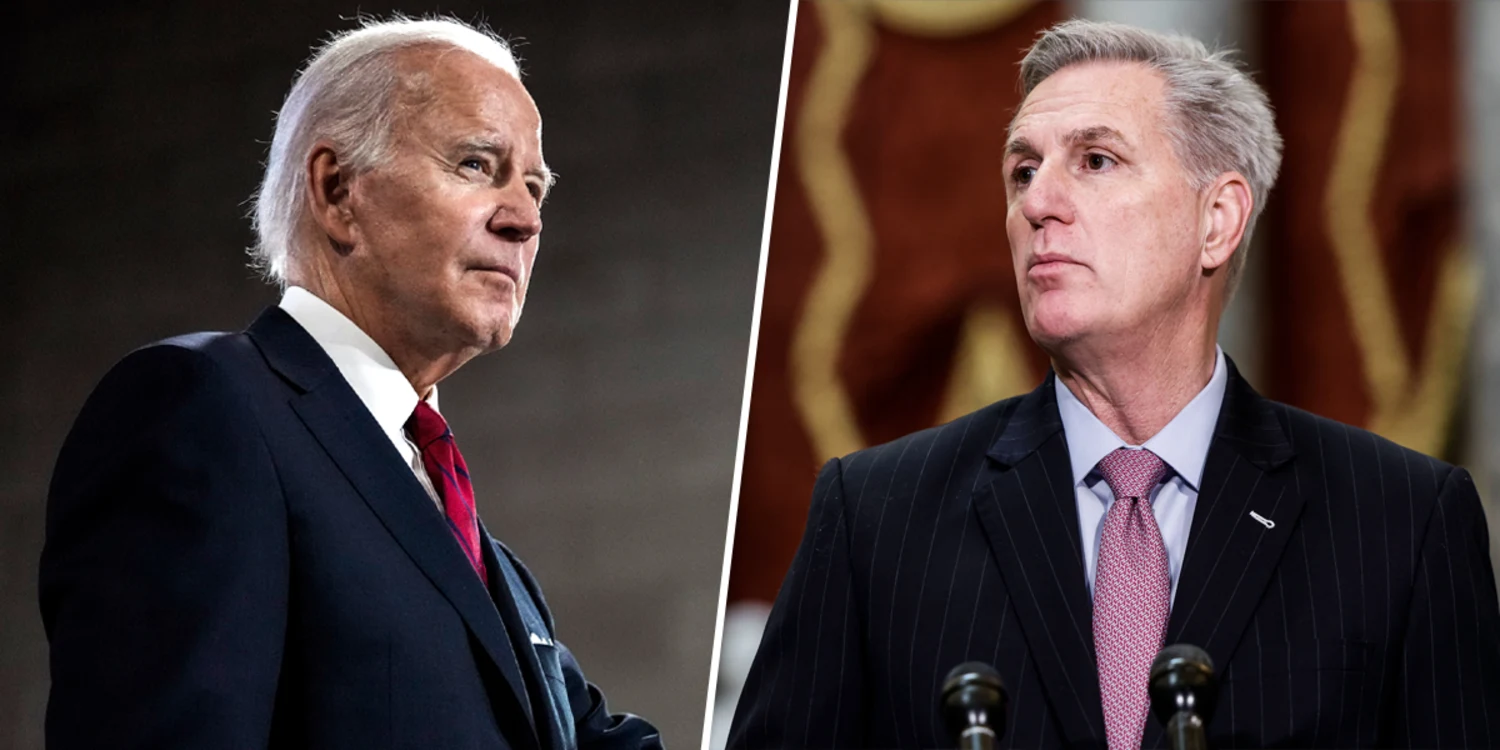

To avoid breaking the debt limit, Congress must raise it. However, this has created a political standoff between Republicans and Democrats because Republicans are using the threat of not raising the debt limit to bargain for their ideas. House Speaker Kevin McCarthy (R) spoke to President Biden recently about temporarily raising the debt limit if a spending cap is set in exchange. McCarthy and other Republicans aim to use the spending cap to balance the US budget by enforcing spending cuts on social programs. However, the White House has explicitly asserted that President Biden is not willing to cede policies to raise the debt limit.

No one wants to break the debt limit, but currently, no one will give up anything to raise it. Many experts agree that Congress will eventually increase the debt ceiling, but political tensioni continues to mount and the US may still face economic consequences.